Chapter 7 Bankruptcy No Further a Mystery

For most, Chapter seven bankruptcy eliminates all of their personal debt. But, there are numerous classes of debt that could’t be discharged in the Chapter 7 bankruptcy. Let’s Consider the most typical sorts of non-dischargeable debts.

Yes. You will really have to pass a way exam that gauges the amount of income you've. Whether it is at or under the median earnings for the location, it is possible to file. Whether it is previously mentioned that, you will have to document your financial explanations for filing.

Soon after filing, the debtor has to finish a economic administration training course ahead of their discharge could be entered. This training course is all over again taken from a credit history counseling company that has been authorized to offer it via the Business of The us Trustee. [3]

You should use an attorney when filing for bankruptcy. This is because there are many going sections and one small clerical error can cause your scenario getting dismissed.

In no way Feel you can get absent with a thing sneaky or dishonest. Your bankruptcy law firm is always a great source for answering inquiries on what on earth is wrong or right in this example.

The Chapter seven bankruptcy trustee assigned to the case is in charge of making sure the creditors get the things they’re because of under the bankruptcy legislation.

Lots of individuals wrongly believe they're able to’t use bankruptcy to remove federal scholar personal loan personal debt. If you're able to display your federal student mortgage financial debt repayment will induce you undue hardship, you may be eligible for just a student loan discharge.

Financial debt administration — When you shrink from the concept of taking over your creditors or credit card debt collectors — and there’s absolutely nothing Incorrect with that — but you continue to like the idea of lessening payments even though acquiring away from personal debt, Make contact with a nonprofit credit history counseling agency.

Chapter seven bankruptcy has the ability to give people who are confused with massive amounts of shopper financial debt a Source massive sense of reduction. In the event you will be able to file and it seems suitable for the problem, it really is truly worth taking into consideration. However, you will discover severe repercussions that very last for many years.

If you can’t afford to hire a bankruptcy lawyer, Upsolve could possibly aid. Answer inquiries inside our app to prepare your bankruptcy varieties without cost and check out our Learning Centre To learn more about getting a fresh get started by bankruptcy.

Even though no person really wants to pay out attorney fees, great site it could be value undertaking if your situation is challenging. And recall, Charge isn’t the only thing to take into consideration when selecting a lawyer. Most bankruptcy attorneys provide a free Original consultation.

Additional on that below. It doesn’t transpire fairly often, however, if it does you’ll see this choose to you should definitely talk to a lawyer about how this impacts your fresh get started.

Our group consists of personal debt gurus and engineers who care deeply about creating the economical process available my site to Everybody. Now we have earth-class funders that come with the U.S. governing administration, former Google CEO Eric Schmidt, and primary foundations.

As a sites qualified Chapter 7 filer, you may have these debts as credit card balances, private loans, assortment accounts, and professional medical expenses discharged in bankruptcy court. Secured financial debt is often discharged, but you'll have to forfeit the collateral put as much as secure the bank loan. In case you don’t want to shed the collateral, you could prefer to conform to pay back the personal debt in a process known as “reaffirming” the debt.

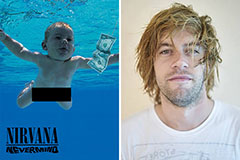

Spencer Elden Then & Now!

Spencer Elden Then & Now! Tatyana Ali Then & Now!

Tatyana Ali Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now! Michael C. Maronna Then & Now!

Michael C. Maronna Then & Now! Danny Pintauro Then & Now!

Danny Pintauro Then & Now!